CLIENT CASE STUDIES

Portfolio comparison & management

We’ve designed this app to easily compare holding companies with peers, ensuring a user-friendly experience that simplifies portfolio navigation and enables addition or removal of specific companies and/or metrics.

Custom algo trading

Our algorithmic trading system connects with brokers and provides real-time and historical value. Optimizes trade execution, with automated trade order processing, dynamic buy and sell signals, and custom-investment strategies.

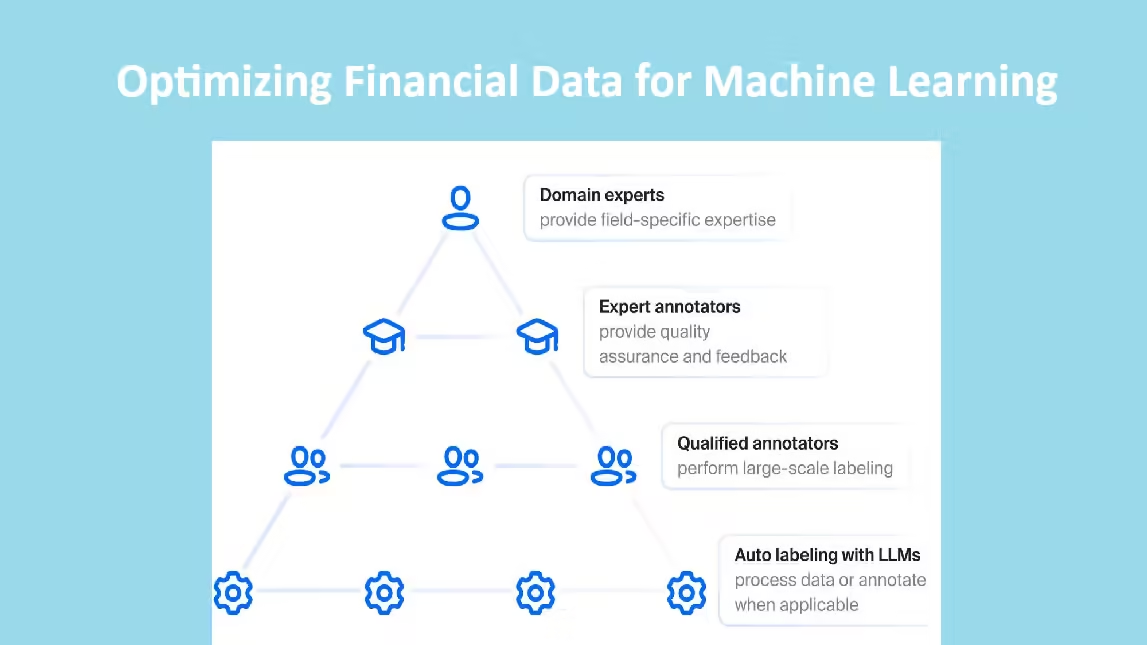

Financial data annotation

We organized, labeled, and performed quality control on financial data to improve machine learning models and analytical tools for our client. Our tasks involved reviewing and tagging various financial documents to ensure that the data was accurate and consistent, facilitating better financial analysis.

Automated retrieval of research data

We automated stock data retrieval. This solution efficiently fetches and organizes daily stock information, reducing manual effort and improving workflow for data management.

Private equity valuations

Our private equity valuation services offer precise, real-time valuations, improved by automated financial model updates and a comprehensive suite of solutions. These services usually are created for effective portfolio management and informed decision-making.

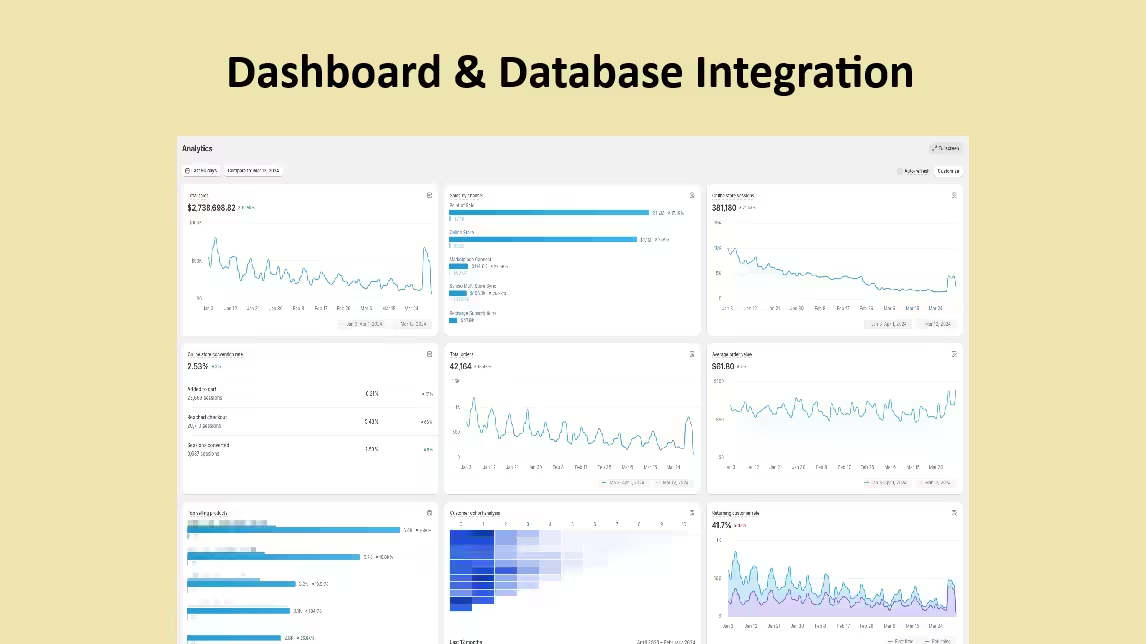

Dashboard & Database Integration

The project involved building a data analytics solution using Google BigQuery as the backend database and Looker to create interactive dashboards and reports. The goal was to provide stakeholders with actionable insights by integrating large datasets and visualizing KPIs for data-driven decisions.